Putting ESG and sustainability into perspective in Manager Selection

![]() Download PDF version

Download PDF version ![]() Visit Mia’s Linkedin profile

Visit Mia’s Linkedin profile

ESG is a set of criteria/principles/factors, which is used to define responsible and sustainable investing. They originate from the UN PRI – United Nations’ Principles for Responsible Investments, launched in 2006, with more than 1800 signatories today. UN PRI consists of 6 principles to follow to be a UN PRI Signatory. The aim of UN PRI is to encourage long term sustainable investments and guide managers on how to invest in a responsible and sustainable way. The ESG- factors are not something that is regulated or has a set and accepted definition, it is only a very loose set of words. This makes it very difficult to measure, evaluate or even define since different players in the financial industry interpret, implement and use these three factors in many ways. It is also the basis of an enormous amount of reporting instruments, stock exchange ESG practices, stewardship codes, memberships, corporate disclosure requirements and political initiatives, which all interpret what to focus on differently.

Sustainable and responsible investments are the fastest growing segments of the investment universe today and are accelerating. Sustainable investments are no longer for tree huggers only, but bring new tools and transparency and offer professional investors the opportunity to build strong portfolios and generate a better and more sustainable return. The ESG-area is a dense jungle to penetrate. In this article, I will try to bring a little order in an attempt to make it easier to understand for those who are new to ESG and sustainability.

Going through the E, S and G

E- Environment

Environmental considerations when choosing the companies you invest in can be made in many ways. The range of ways it is interpreted is endless. Some investors only avoid the worst obvious offenders and feel they have taken the E factor into consideration, while others go all the way to find the companies who develop and use the latest technologies and knowledge to find the solutions to the most relevant environmental challenges. Fund managers and analysts can look at how corporations are dealing with issues such as energy efficiency, greenhouse gas emissions, carbon footprint, preservation of forest and water life, chemical use etc. Fund managers can also choose to buy the ones who already do well in these areas, buying the sector leaders, or buy the corporations that make the largest changes towards a more sustainable operation, it is all about how ambitious they are. What message they want to send to the fellow investors and the industry. How to interpret the E in the ESG setup can reach all the way from negative screening with relative low thresholds to the forefront investors in the Impact investing area.

S – Social

The S stands for Social. Having social considerations in the analysis of corporations in an investment process can involve taking considerations regarding factors such as staff turnover, workers’ rights, how the staff are treated, if they are paid a decent wage, how a country/corporation is respecting human rights, gender diversity, workers health and safety, social impact on the society etc.

G – Governance

The G stands for Governance. Taking governance issues in to consideration is the most common and widely used of the three letters by managers. Many fund managers put the G as the most important factor to consider. This is very rational since the G is crucial to obtain the S and the E. Governance issues are usually also of great importance to managers who not necessarily see themselves as ESG-investors. The G focus on subjects such as corruption, management of the firm, board members and leaders in the corporation, litigation risks, risk management, historic conflicts and the companies’ ability to handle and solve it etc. Academic studies have shown that strong environmental and social standards stem from a good governance structure, why it is of great importance.

How managers understand it.

Since there is no regulated standard, or common practice or measurement there is almost as many ways to interpret ESG-investing as there are fund managers, selectors and fund companies.

Problems – Some fund companies have an interesting ESG agenda, but the managers have little interest in it. Some Fund companies are signatories to UN PRI but do not at all live and breathe the purpose of ESG investing. The grade UN PRI give the managers is not disclosed and made public, it is up to the fund companies if they want to reveal it or not. Some managers think it is enough to screen out the worst offenders and some use a scorecard where good result in the G can compensate for a lousy result in the E and the S. Others use a scorecard but only adjust their positions a little after it, they only let it affect their portfolio construction process to an extent that it doesn’t mess to much with their usual process. Many managers try to go around or squeeze in the ESG factors just to be able to invest the way they are used to.

And better ways – Some managers see it as an opportunity to adjust their strategy and investment process to make it more adaptive to the ESG factors since they believe it will sort out the companies sensitive to stricter regulations that can impact their profits negatively. There are also managers who look for the ESG stars since they believe these are the ones best suited to handle the future of stricter regulations and find the products and services for the bright future. Many fund managers have realized that having an edge competence in the ESG area will, in the long run, give them better more stable returns since the ESG factors tend to lead you towards successful quality companies.

The range of how managers interpret and use the ESG factors and how they incorporate it in the management of their fund is very diverse. Many funds use fixed quant factors to build scorecards, negative screening, passive strategies built upon external ESG data, constructing their own smart beta products with ESG data etc. The possibilities and ways ESG can and will be used are endless.

Why consider ESG

The reasons to invest in the sharpest ESG managers are many.

- Returns– The market is increasingly demanding sustainable investments. In five years’ time, it will probably be compulsory to take ESG factors into consideration if you want to attract both larger institutions and well-informed retail investors. The market for non-ESG-managers will probably be scarce. This leads to massive inflows in funds who have proven good ESG managers. This, in turn, will increase the demand for companies who have ESG as core values, and there will most likely be a sustainability premium of significance. As an early adopter, you will probably benefit.

- Stability -Fund managers who are good at ESG investing will give you more stable returns, since they use the ESG factors as an evaluation and risk tool, leading to better-informed investment decisions, avoiding companies running into problems. If it is a good fund manager with great ESG skills he or she will also give you higher returns since they will invest in quality companies with great ideas and knowledge, who serve the market with sustainable products and services demanded, which we already have good examples of.

- Avoid scandals -Proper ESG analysis and management will likely make the probability for having a position in a scandal company substantially less. BP’s oil spill and Volkswagen’s emission scandal are examples of companies who most likely wouldn’t have been in a well-managed ESG portfolio even before the scandals, Volkswagens leadership and management problems were well known long before the scandal.

- Getting ahead -It is likely that companies in the future will be valued partly after their sustainability, it will be a crucial factor when analysing their market value. This will favour those who master excellence in the ESG analysis area and have done so for quite some time and developed a successful analysis and process regarding ESG investing. If you invest in a good ESG orientated fund, you will most likely benefit from this too.

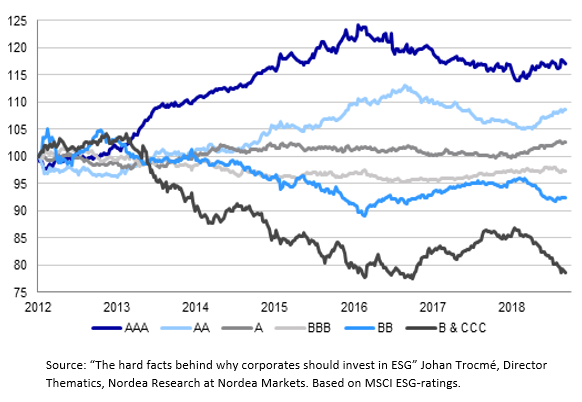

According to a recent study made by Nordea, there are three very clear indications based on hard facts and statistics, based on MSCI ESG scores, why it is crucial to take ESG factors into account.

- In Europe, the companies with the highest ESG scores have outperformed the poorest scorers by more than 50% since 2012.

- Corporates which manage to improve their ESG scores and earn better rating strongly outperform the companies that see their ESG ratings decline.

- Among the top performers, the volatility in returns on capital employed is less than half that of the worst ESG performers among the European listed companies.

This is in line with a large number of other research, which also claims there are substantial gains to incorporate ESG in the investment strategy and process.

“No investor should be able to argue that they can afford to ignore the ESG performance of the companies they invest in”

– Mathias Leijon, Global Co-Head of Corporate and investment Banking, Nordea.

When are you compliant (and not)?

The dilemma regarding ESG investing is that there is no regulation regarding when you are compliant or not, it is pretty much up to every manager and fund company to explain and show in what way they claim to be ESG compliant. Some claim to be so since they are a UN PRI signatory, but a vast part of the industry do not consider that enough. What ESG-compliant means and in what way it is implemented in the portfolio is up to the different actors in the financial industry to decide. There is no black and white, yes or no whether you are compliant or not, there is an endless scale of grey shades in between.

Greenwashing or window dressing do exist and both can be easy to recognize but also sometimes a bit harder. When holdings consist of stocks that are hard to fit into the scope of ESG integration in the investment process there is a problem. Russian oil companies, especially the partly government-owned, are very hard to justify in an ESG-integrated portfolio, for many reasons. To have an ESG policy that looks good on paper but is not in practice on asset management level are often revealed in the holdings and in the explanations given by the portfolio manager. If the strategy is run only on metric data, it is crucial to examine the process and systematic methods that end up in a list of holdings and make sure it is consistent and makes sense.

What should selectors look for?

“What is often lacking today is a holistic view about what sustainability actually means for the asset manager and how this is implemented in the research, investment process and throughout the value chain of the services it provides to its clients”

– Martijn Oosterwoud, Head of sustainable and impact investing specialists, UBS

Philosophy and methodology – What are the basic philosophy of the fund? To examine the portfolio manager’s philosophy and look for asset managers with a very clear definition of what responsible and sustainable investment is is crucial. What it means to them and their interpretation of ESG investing and how it is implemented in the portfolio is key. The fund company’s philosophy and ESG agenda are also important, but the examination can never stop at asset management company level since it is rather common that the company agenda is far more ambitious than the portfolio managers’ interest in it. Compare the company ESG agenda with the manager’s philosophy, do they align, and does it show in the fund’s strategy, methodology and holdings? How dedicated to sustainability is the portfolio manager?

Holdings – It is crucial when looking at ESG investments to look at the holdings. Do the holdings align with the stated strategy and investment process? It is not rare to find holdings that at first look do not fit into strategies, which claim to be ESG integrated or sustainable. The reason why it is there can be a lack of actual ESG integration or can be very accurate and clever even if it at a first glance seems to be misplaced. The list of holdings must be very thoroughly examined and a discussion with the portfolio manager is necessary to understand why the portfolio consists of the present holdings and in what way the stock made it into the portfolio. Does the portfolio manager have a view on ESG investing that align with yours regarding what ESG really is?

ESG Controversy– an interesting subject to discuss with the representatives of the investment product of interest is their view on ESG controversies and how they handle them. This can vary widely but there is not one correct way or answer. Some fund managers exclude the worst offenders by using controversy data ranging from 1(low) to 5(severe) on a company level, and research shows that excluding the worst offenders can have a positive impact on portfolio performance. Others have their own analysis department and try to follow the market development in the ESG area to obtain information before it gets incorporated in widely used ESG-data, and benefit from changes in it. Some managers don’t bother with this at all, rely on other kinds of analysis and data and have their reasons for that. The interesting part is their view and their actions and controversy data can never be the one and only level of assessment, it is only a small piece in the much bigger jigsaw puzzle.

How to use ESG / How far should you go

There are a vast number of ways to use ESG factor integration as a criterion in fund and manager selection. What it all boils down to is how it affects the final investment decision in the portfolio construction process and portfolio strategy. It is common to divide the ESG-concept into four under groups or definitions depending on the level of dedication to the ESG agenda. Exclusion, ESG integration, Sustainability focus and Impact investing and you as a selector or investor need to understand what you are looking for and be well informed of the different levels of integration and dedication. If you truly look for an ESG integrated investment, you need to make sure that ESG really matters to the portfolio manager in a very hands-on way.

Since the market for ESG data, systems, scorecards etc. is huge, with over 400 different sustainability-reporting instruments, the likelihood that you will encounter a portfolio manager only relying on these products is likely. It is crucial to evaluate if the data and systems are used in a fruitful way or if the data screening, filtering and scoring systems have hijacked the investment process.

Many asset managers emphasize the number of sustainability evaluation systems or sustainability data they use, but the crucial point is how sustainability orientated the portfolio management really is, which strategy does he use and what analysis is made, what methodology and investment process is used and is it all consistent and makes sense?

The hands-on dialogue-based investment decisions usually lead to a portfolio manager with greater insights and more deeply analysed investment decisions, and those usually give you all the information you need in a very knowledgeable and structured way.

My experience tells me that it is often necessary for asset managers to meet the companies directly and have a meaningful and engaged interaction and open dialogue to understand their vision an ability to deal with sustainability-related risks and opportunities that really matter to their performance.

Ratings – dedication is not always shown in ratings.

There are many kinds of ratings, memberships, signatories etc. on the market, my view is that it can be a part of a bigger picture, but it is impossible to assess whether a fund or an investment product is truly ESG compliant and sustainable in your own view of what it means only by running a set of data. Many funds use too much data and too many systems ending up in a box-ticking exercise and a sea of memberships or sustainability ratings. Where it becomes more important to a portfolio manager how he is measured and what sustainability rating he scores rather than having a truly sustainability-focused agenda.

“Do you know how many Morningstar Globe points Boston Common Asset Management’s funds get for leading a coalition of investors to persuade banks to limit coal financing? How many points Trillium’s funds get for leading an investor statement opposing North Carolina’s discriminatory bathroom bill, part of an ultimately successful effort? And what about all the fund managers that have pushed companies to stop funding organizations supporting climate denial, address the gender pay gap, phase out antibiotic use, and much more? No points. Exactly zero.”

– Cary Krosinsky, President and Co-founder, Real Impact Tracker; Lecturer, Yale College, Yale School of Management, Brown University; Editor/Author/Advisor: Sustainable

Dedication – A very dedicated manager can have an agenda that diverges largely from a rating’s underlying setup, which makes it look bad when it is way better than many of those with higher ratings or more memberships. The ESG data-based ratings do not give any credit to asset managers on their efforts on shareholder engagements or brilliance in their investment strategy.

Divestments are not always the solution. It rejects the possibility to influence and push the company in a more sustainable direction through active ownership. There are accurate examples of very dedicated impact investing fund managers who do not have the highest sustainability rating since he or she invests in companies with low scores because the companies owned come from an even lower rating but have started a very important journey. To uphold and encourage that journey through active ownership makes a much larger impact than to invest in those companies who already do well, and do not really make any improvements.

Distractions -The rating itself can also be misleading since it often measures peer groups of companies in a sector or fund group and leads the investor to think that ratings are comparable over all sectors and fund groups which often is not the case.

The easy way out– Many asset managers see controversy and company ratings and sustainability data as an easy way out. There is a lack of knowledge in the industry when it comes to sustainable investing. Getting to know the depths of sustainable investing takes time, energy, endless discussions and education. Many analysts and asset managers haven’t had the exposure to the topic and don’t know how to fit it into their work and how they look at companies and investments. Ratings and bulks of data become the easy way out. Portfolio managers often prefer hard exclusion rules and rating frameworks since they don’t have to spend time and efforts to educate themselves on the subject. With rating data and exclusions, they look ok and can continue doing what they do without too much of a hassle. The problem with this approach is that much of the necessary analysis is lost along with the asset manager’s ability to improve both analysis, investment process and overall results as well.

“Standardized ESG ratings create a risk of a lazy implementation of sustainability into asset management, as it allows analysts and portfolio managers to “justify” a view rather than analyse and understand it.”

– Martijn Oosterwoud, Head of sustainable and impact investing specialists, UBS

Divergence– Holding-based ratings is also a problem since ESG data diverge largely. One company can be measured differently depending on who’s data it is based on. There is no ESG-consensus on what to measure, or how to measure it. Whether voluntarily disclosed data should be included or other data than the data provided by the company itself. The correlation between two major rating systems, Sustainalytics and MSCI are only 0,32. It is, of course, good to measure different ESG-factors, but since there is no consensus on what to measure and how it can be very confusing.

Unreflected importance -The problem with ESG operational excellence data, is that there are so many factors that are important but aren’t reflected in that kind of data. The effects or impact of the products or services a company provide is not reflected in these data. Most serious sustainability analysts would agree that a company’s actual output in form of product and services is a crucial part of the assessment of whether a company is sustainable or not. When it comes to measuring ESG factors in companies in emerging markets, the information is scarce and often unreliable and therefore a rating on a fund covering that market or a company operating therein is likely not telling much.

The race for ratings rarely ends up in a marketing machine game rather than a more sustainable portfolio. The window dressing and greenwashing by asset managers to fit into the rather tight ESG-shoe can be rather extensive.

On the positiveside there are fund managers who have taken control over the lack of sufficient data and built their own way to analyse and do research to establish a complete picture where the ESG factors fit in and improve their investment strategy, gaining better, more stable returns.

“The lack of agreement and robustness among various ESG ratings and data sets is a constraint for some. But the good news is that fundamental investors can use ESG research – both quantitative and qualitative – without waiting for more perfect data sets. We have found success over time by using an ESG lens as an additional way of understanding a company’s business model and evaluating its return prospects independently from the market.”

– Karina Funk, Fund manager- Brown Advisory US Large-Cap Sustainable Growth

The race for ratings often results in a marketing machine game rather than a more sustainable portfolio. The window dressing and greenwashing by asset managers to fit into the rather tight ESG-shoe can be rather extensive.

On the positive side, there are fund managers who have taken control over the lack of sufficient data and built their own way of analysing and do research to establish a complete picture where the ESG factors fit in and improve their investment strategy, gaining better and more stable returns.

Taking it one step further – Impact investing, what is that?

Impact investing is to take the sustainability agenda one step further. Impact investing means investing in companies as a means to generate a measurable, beneficial social or environmental impact alongside financial return. Sustainable investments are the fastest growing segment of the investment universe today and impact investing is the fastest growing area within sustainable investing. Impact investing will likely compete for the leader position on its own in a few years since the interest in this kind of investments is immense.

Many investors start to realize that there is no trade-off between doing good, supporting a sustainable future and getting competitive returns any more. Impact investing is not for tree huggers only, but for the investors who want to make their capital work in more than one way simultaneously.

Impact investing funds often focus on special factors such as climate, food, health, poverty and water. Lately, there is several impact investing funds who aligned their strategy with the United Nations ambitious sustainable development goals (SDG), where every investment must be linked to one or more of the united nations 17 sustainable development goals. The goal is to give the investor social returns as well as financial by investing in companies offering solutions for these challenges and create measurable social and environmental impact.

Fund companies dedicated to impact investing often collaborate and have set up partnerships with universities to develop a set of impact measurement metrics, to obtain a very accurate number of lives saved or other specific numbers of impact. Impact investors often engage with companies they invest in directly to obtain greater insight into impact measurement. The most successful impact investing funds have often an extensive experience of impact investing reaching long back in time and have attracted employees with leading skills on the subject and invested substantial means into building up a credible organisation around it.

This kinds of funds were only accessible for a very limited number of clients, usually the very large institutions and pension funds, but now, since the interest has grown and demand for impact investing is accelerating there is a growing number of products open even for the smallest retail client.

Even if there can be frustration regarding the lack of knowledge and the shortcuts thru quant data and ratings in the financial industry it is slowly and truly making a very definitive movement. A movement towards both more sustainable and impact investing especially since more and more investors understand the financial gains it brings and the interest and search for more knowledge is increasing. Every step towards more awareness and more knowledge and more attention, even if it sometimes takes the path of marketing agendas and box checking exercises, all those steps are better than no steps towards a more sustainable investment universe.

If you want to be serious about investing in ESG-compliant managers – do your own analysis and be thorough

– Mia Söderberg